BELA

A UNIT OF LEGALLANDS

BUREAU OF ECONOMIC AND LEGAL AID (BELA) is a business enterprise of LEGALLANDS, which aims to provide trade, commerce, legal, regulatory & compliance support to entrepreneurs for the market expansion with risk assessment and least regulatory & legal hassles of foreign land.

BELA provides a state-of-the-art platform for fostering economic growth by entering the shoes of entrepreneurs and leveraging the expertise of its trade, industry specific and legal & financial team expert having alliance partners across various nations all-over the globe.

The WORLD trade has opened its horizon and every nation believe in

वसुधैव कुटुम्बकम – Vasudhaiva Kutumbakam

“ONE EARTH, ONE FAMILY, ONE FUTURE”

ELEMENT 1 – ENTRY STAGE EVOLUTIONS

BELA bifurcates the First Stage of into two categories:

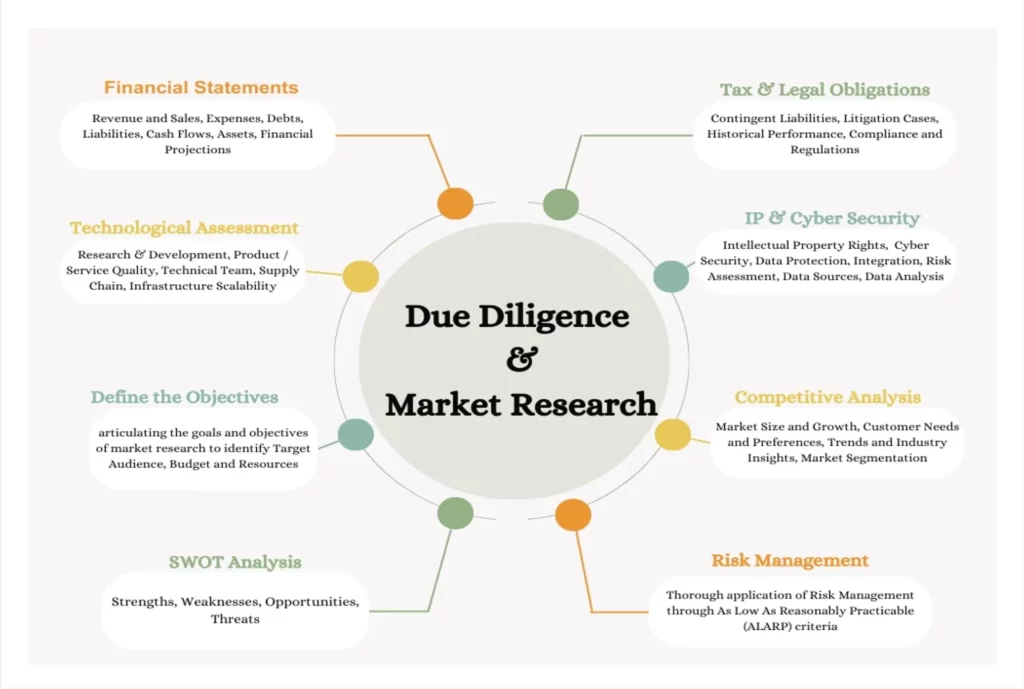

- DUE DILIGENCE: The due diligence process in very vast and to cover all business-specific aspects BELA has categorised it as:

- BUSINESS DUE DILIGENCE

- LEGAL DUE DILIGENCE

- FINANCIAL DUE DILIGENCE

- RISK ANALYSIS: BELA specializes in addressing the following risk to align its approach with the specific needs of the client’s business:

- ECONOMIC RISK

- POLITICAL RISK

- STRUCTURAL ASSESSMENT

- DEBT MANAGEMENT

- COUNTRY RISK RATING

ELEMENT 2 –ENTITY FORMATION & STRUCTURING

The Second Element of BELA undertakes the requirements needed for Entity Formation and structuring such as:

- PRE-INCORPORATION COMPLIANCES: Business Objective Assessment, Country selection, Trade Name Selection, Company structure and determination, Pre-Setup permits and permission, Regulatory Adherence.

- COMPANY REGISTRATION: Including Setting up of a Joint Venture, Foreign Collaboration, New Entity, or a Wholly Owned Subsidiary, or a Branch Office or a Representative Office at Foreign Land.

- POST- INCORPORATION COMPLIANCES: Including Company name and seal/signature, Post-Setup permits and permission, Tax registration, Taxation law, company law and financial law

compliances.

ELEMENT 3 – TRADE SPECIFIC PERMITS

Every business requires licenses and registrations to operate smoothly. BELA provides these licenses based on the specific requirements of the business or company you want to start.

The third Element herein divides these specific permits into four categories, which are:

- ENTRY LEVEL PERMITS: including Business License, Import- Export License, Environment and Safety Permits and others.

- INDUSTRY SPECIFIC PERMITS: Specialized License, health care related licenses, Education, Food & transport sector specific Licenses.

- COUNTRY SPECIFIC PERMITS: Including Taxation registration and Certificate.

- QUALITY ASSURANCE: Country Specific and Industry based Quality Assurance licenses including FSSAI, FDI etc.

ELEMENT 4 – ESTABLISHMENT SETUP, HUMAN RESOURCE & IMMIGRATION ASSISTANCE

The world revolves around human intervention and Human Resource is an integral part of the business environment.

BELA ensures the adequate compliance with the human factor of business by providing the following:

- COUNTRY SPECIFIC PROFESSIONAL HR FOR MARKETING, RESEARCH, REGULATORY & ASSURANCE SERVICE: This shall include providing Experienced working Professionals and Assistance with Recruitment through HR Agencies as required by the enterprise.

- ASSISTANCE WITH INTERNATIONAL EMPLOYEES: It shall include providing Immigration Services such as Work permits, Resident Permits, Entry Permits or Manpower placement including Logistic support.

ELEMENT 5 – CONTRACT CONVEYANCING, TECHNOLOGY TRANSFER, NETWORK SELECTION AND IPR PROTECTION

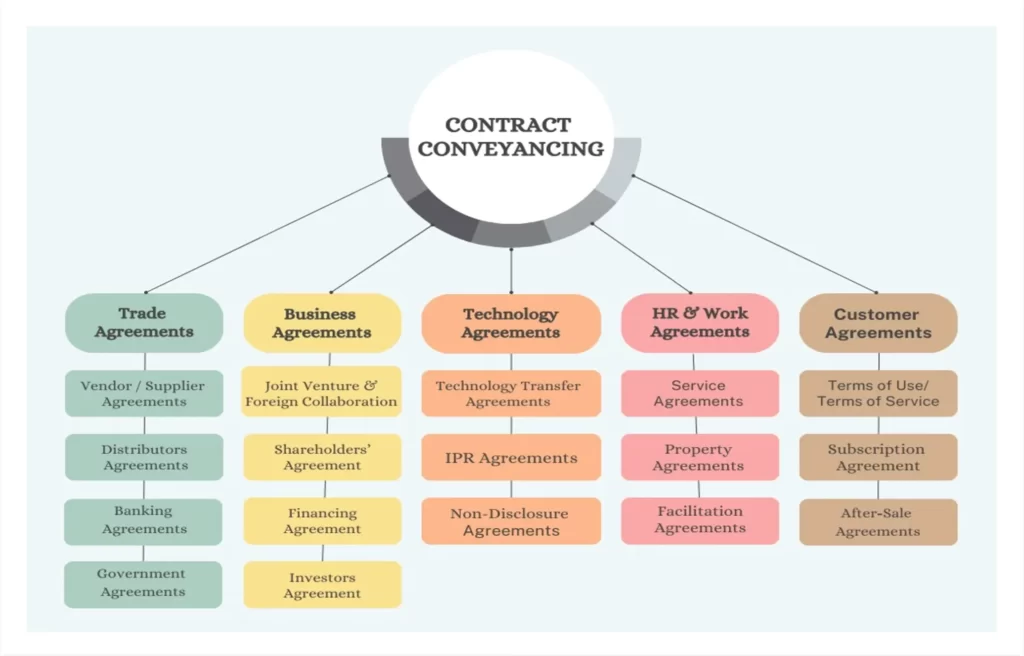

Every business needs to operate its functions by complying with all the legalities, and to smoothen the functioning one has to abide by the acceptance of the agreements and contracts with the parties

The Fifth Element of BELA undertakes the Contract Convencing element wherein BELA shall, depending upon the unique business needs provide for Contract drafts including:

- TRAGE AGREEMENTS

- BUSINESS AGREEMENTS

- TECHNOLOGY AGREEMENT

- HUMAN RESOURCE & WORK AGREEMENTS

- CUSTOMER AGREEMENTS

ELEMENT 6 – DISTRIBUTION CHANNEL, WAREHOUSING & LOGISTICS

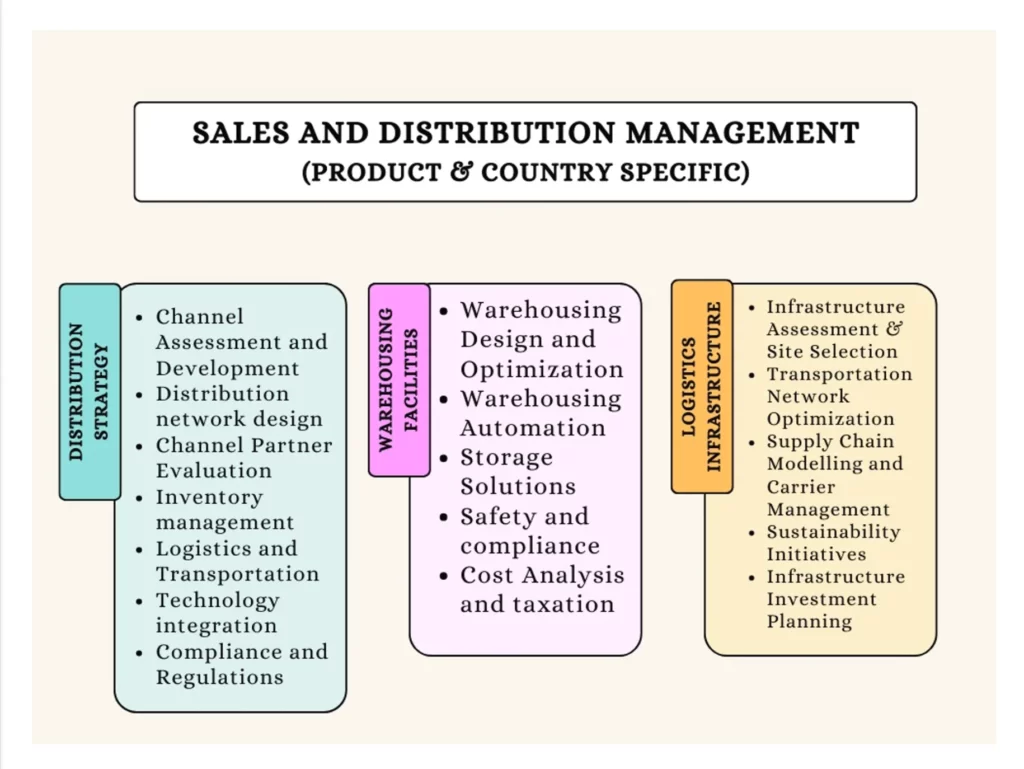

Expanding business overseas requires a robust Industry Distribution Channel along with efficient Warehousing and Logistic Support.

Element 6 elaborates some key services that BELA shall ensure under Sales and Distribution Management:

- DISTRIBUTION STRATERGY: Includes channel assessment and development, providing Distribution network, technology integration and others.

- WAREHOUSE FACILITY: Business specific storage solution, with warehousing design and optimization, cost analysis and taxation and others.

- LOGISTIC INFRASTRUCTURE: Including Infrastructure assessment and Site selection, Supply chain modelling and carrier management and much more.

ELEMENT 7 – BANKING & FINANCES, REGULATORY & AUDIT ASSURANCE, LITIGATION SUPPORT

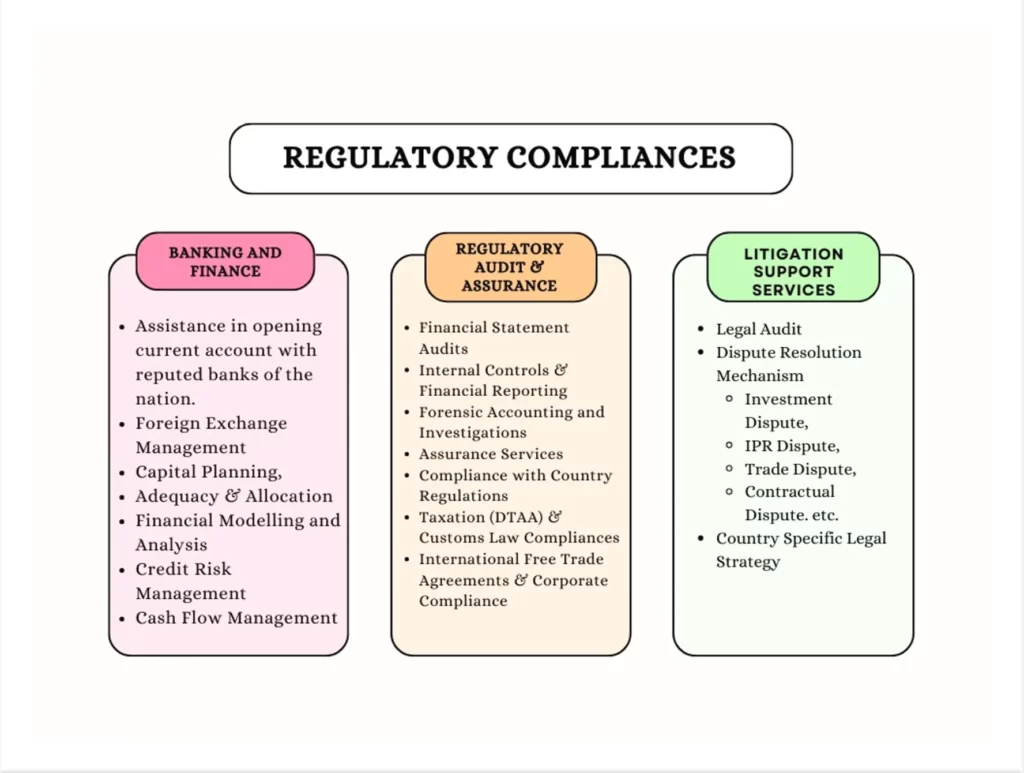

Every business needs a proper and secure banking channels and mandatorily has to maintain the books of accounts to facilitate the day- to-day operations for a smooth working environment.

BELA ensures to comply with all the business specific Regulatory Compliances including:

- BANKING & FINANCE COMPLINACES: Includes Assistance in opening bank accounts, foreign exchange compliances, capital planning and more.

- REGULATORY AUDIT AND ASSURANCE: Such as Financial Statement Audits, Assurance Service and much moew.

- LITIGATION SUPPORT SERVICES: Such as Legal Audits, Dispute Resolution Mechanism and Country Specific Legal Strategy.