INTERNATIONAL TRADE CONSULTANCY

FREE TRADE AGREEMENTS

LOGISTICS SUPPORT

INTERNATIONAL TRADE FACILITATION

International Trade Facilitation

FREE TRADE AGREEMENTS

S. No. | Name Of Aggrement |

|---|---|

1 | India-Sri Lanka Free Trade Agreement (FTA) |

2 | Agreement on South Asian Free Trade Area (SAFTA) (India, Pakistan, Nepal, Sri Lanka, Bangladesh, Bhutan, the Maldives and Afghanistan) |

3 | India-Nepal Treaty of Trade |

4 | India-Bhutan Agreement on Trade, Commerce and Transit |

5 | India-Thailand FTA - Early Harvest Scheme (EHS) |

6 | India-Singapore Comprehensive Economic Cooperation Agreement (CECA) |

7 | India-ASEAN CECA - Trade in Goods, Services and Investment Agreement (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam) |

8 | India-South Korea Comprehensive Economic Partnership Agreement (CEPA) |

9 | India-Japan CEPA |

10 | India-Malaysia CECA |

11 | India-Mauritius Comprehensive Economic Cooperation and Partnership Agreement (CECPA) |

12 | India-UAE CEPA |

13 | India-Australia Economic Cooperation and Trade Agreement (ECTA) (*) |

(*) Signed, but yet to be implemented. | |

In addition, India has signed the following 6 limited coverage Preferential Trade Agreements (PTAs):

S. No. | Name Of Aggrement |

|---|---|

1 | Asia Pacific Trade Agreement (APTA) |

2 | Global System of Trade Preferences (GSTP) |

3 | SAARC Preferential Trading Agreement (SAPTA) |

4 | India-Afghanistan PTA |

5 | India-MERCOSUR PTA |

6 | India-Chile PTA |

LOGISTICS SUPPORT

PREVAILING TYPES OF BUSINESS ENTITY IN INDIA

LOGISTICS is the process of planning, implementing, and management of the efficient, cost-effective flow and storage of raw materials, in-process inventories, manufactured goods, and relevant information from the origin point to point of consumption to satisfy customer needs. The two main functions of logistics are transportation and warehousing.

Transportation management is a complex process that involves planning, optimizing, and executing the use of vehicles for moving goods between warehouses, retail locations, and customers.

Warehousing includes functions such as inventory management and fulfillment of orders. Also involves managing warehouse infrastructure.

INBOUND LOGISTICS: Inbound logistics is the transportation, warehousing, and delivery of goods into a business. It is all about procuring things for the workplace or the production unit. A manufacturing company’s production unit purchases raw materials or components from its suppliers to produce other products.

LOGISTIC MANAGEMENT: Logistic management is a part of supply chain management. Logistics management promotes place and time utility, i.e., product at the right place and at the time required by customers. It is the process of the integration and management of goods. The supply chain is constantly changing, so the logistics must be flexible and agile to adapt to these changes and also to provide services to customers. The main objective of logistic management is customer satisfaction.

LOGISTICS CONSULTANTS, evaluate and improve logistical processes. They analyze the supply chain operations, generate cost-efficient methods to improve logistical procedures and implement strategies into action. Logistical consultants also consult in warehousing, manufacturing, transportation, or distribution. Planning a logistics investment requires a substantial understanding of the industry and its technical features.

Responsibilities of logistic consultant:

- Examine the logistical process to identify the strength and weaknesses.

- Analysing the supply chain data and identifying risks.

- Create cost-effective solutions and interventions to improve logistical efficiency.

- Take approval and advice from senior managers on improvement plans.

- Convey the improvement strategies to all the departments and also provide the training facility(sessions).

- Providing guidance and support while reviewing the implementation of improvement strategies.

- Examining the effect of improvement strategies and making necessary modifications

- Increase the effectiveness of communication channels between consumers, vendors, and suppliers.

- Documenting improvement strategies, setting timelines, and tracking progress.

SERVICES OF LOGISTIC CONSULTANCY:

- Commercial Contracts and Corporate Advisory:- Logistic consultants act as an advisor to large entitled enterprises and small businesses in the logistic space for managing contractual requirements of businesses and organizations. They also act as a standing advisor to the large logistics company on various statutory, contractual, and M&A matters.

- Disputes:- Logistic consultants, assist businesses with their dispute resolution requirements by advising logistic companies concerning claims made against the company, recovery of amounts from a client under insolvency, and pre-dispute advisory to logistic clients on various related matters.

- License:- A license is an authorization issued by one party to another party to use licensed goods owned by the first party. There are three types of warehouse licenses, ordinary warehouse license, Public Bonded Warehouse License or Private Bonded Warehouse Licence.

SELECTION OF LOGISTICS CONSULTANT

A good logistics consultant must be able to assist the customer or organization by designing cost-effective supply chain solutions. This may be accomplished by developing an appropriate logistics network design to minimize product handling, resulting in a cost-effective distribution network.

The choice or selection of logistic consultants should depend upon the experience and success of defined criteria and not on the lowest-cost solution.

INTERNATIONAL TRADE FACILITATION

When the highly esteemed lawmakers around the globe discuss “trade facilitation,” usually they refer to certain policies which expedited and smoothen the sophisticated and regulatory processes for goods and commodities setting their foot in or are leaving the territory for global commerce. As such, trade facilitation encompasses the entire range of international frontier processes, from the digital interchange of consignment information to the simplicity and standardization of trade documentation to the capacity to challenge authoritative rulings imposed by cross-frontier agents.

The definition & application of the phrase “trade facilitation” contrasts in academia and among professionals. The term “trade facilitation” is commonly used by organizations that attempt to enhance the compliance interaction between statutory agencies and merchants at territorial frontiers. In an internet-based learning program, the World Trade Organization defines trade facilitation as “the streamlining and coordination of global commerce procedures,” with commerce practices defined as “the activities, practices, and etiquettes associated with collecting, presenting, communicating, and processing data required for the mobilization of products in global commerce.”

In this era of globalization of the world economy where items frequently transcend frontiers as both transitional and ultimate outputs, trade facilitation contributes to reduced total trade expenses and increased socioeconomic wellbeing, particularly for underdeveloped and developing nations.

Trade facilitation has evolved as a critical component in cross-border commerce performance and productivity and national economic growth. This is because of the influence it has on efficiency and economic unification, as well as its growing relevance in luring substantial foreign investment. In recent times, it has acquired importance in the global diplomatic discourse, culminating in the signing of the World Trade Organization’s Agreement on Trade Facilitation as well as broad international technical assistance programs for emerging and transforming countries.

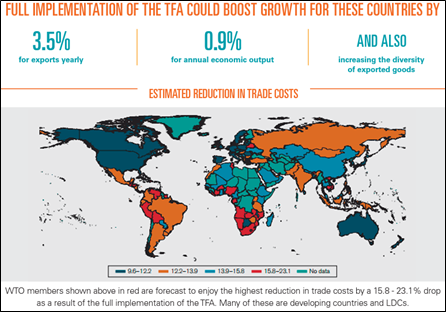

Member nations of the World Trade Organization (WTO) concluded discussions for the WTO Trade Facilitation Agreement (TFA) in Bali, in December 2013, which establishes international regulations to tackle particular procedural barriers in an attempt to expedite commercial protocols. The TFA went into effect in 2017 and provides substantial potential for nations to enjoy socioeconomic advantages through faster and more efficient international frontier formalities.

The WTO TFA has become the fundamental benchmark regarding trade facilitation, including numerous nations attempting to enforce policies that transcend those listed in the Agreement in an effort to preserve competitiveness in international economies. To substantially cut commercial expenses, numerous nations have concentrated their trade facilitation initiatives on building internet-based single windows as well as paperless trading platforms.

The TFA is a lawfully enforceable international pact adopted by Member nations. The Agreement includes provisions for speeding the transfer, discharge, and approval of commodities, even those in transit. It also outlines steps for efficient collaboration among customs and other relevant agencies regarding trade facilitation & customs adherence concerns. The notion of exceptional and unequal handling is among the TFA’s pillars. This enables emerging and under-developed nations to identify the actual obligations that they will enforce within defined time constraints.

A few of such obligations may be implemented with analytical and monetary help from emerging and under-developed nations. States must classify the (Article 1 to 12) regulations into three different groups (A, B, and C) and inform their fellow WTO member nations of these classifications. There are roughly 36 trade facilitation methods within the TFA’s 12 Articles. The methodologies may be divided into 238 reportable small article items, with members authorized to identify particular goods as Category A, B, or C. So far, member nations have notified 47 percent of the products under Category A, 11.7 percent as Category B, and 15.9 percent as Category C, and the remaining 24.7 percent have not been reported yet. As per the WTO TFA Database, 60 nations have reported their Category C obligations, with the majority requesting technical support and guidance on a whole or portion of the classifications. Personnel capacity & conditioning, legislative and administrative guidelines, ICT, organizational processes, facilities and apparatus, diagnostic and requirements evaluation, and consciousness are among the technical support requests. Nations can modify or postpone the enforcement of their Category B and C regulations. Category A regulations enacted by emerging nations are exempted from conflict resolution for two years after they enter into effect, and six years for LDCs. LDCs’ Category B and C regulations are free from conflict resolution for an eight-year term.

Category A covers prerequisites that an emerging nation will put in place upon the TFA’s admission into implementation. Least-developed nations (LDCs) must execute their Category A regulations within one year of their ratification. So far, 114 nations had declared their Category A regulations, in accordance with the WTO TFA Database, which was last modified on 15 October 2018. Category B covers regulations designated for execution after a transitory stage following the entrance into effect by emerging or under-developed nations. In this scenario, a nation informs other fellow member nations of the precise regulations and estimated timeframes of enforcement no later than one year following entrance into effect. So far, 71 nations have reported their Category B regulations, according to the WTO TFA Database.

Trade facilitation has enormous economic benefits for both government agencies and the commercial sector. State bodies will benefit from higher trade duty collection, efficient utilization of resources, and enhanced vendor adherence. The government will be able to sustain robust security standards and competent administrative oversight while reducing the potential for corruption if public services are delivered in a sufficiently streamlined and truthful manner. Businesses will benefit from increased consistency, timeliness, and reduced transactional expenses, leading to more viable shipments across international economies.

Eliminating unwarranted interruptions & expenses encourages investments and fosters development and employment generation for overall economies. Trade facilitation initiatives can especially help underdeveloped nations since exporting commodities might take three times as long as it does in affluent nations. Exports from poor nations need roughly twice the number of paperwork and six times the number of approvals as per the “World Bank report on Doing Business 2012”. Additionally, trade facilitation is crucial for ephemeral agro-based commodities as well as technology-heavy industrial components that are oversensitive to long waits and postponements. Further, in the internet age, trade facilitation is getting more and more crucial. The rising volume of shipments entering international frontiers increases demand for trade facilitation while also posing fresh concerns.

Executing trade facilitation neoliberal initiatives is undoubtedly pricey, and facilitation solutions must be selected to optimize advantages. However, there are several prospects for profit, as evidenced by numerous research and papers, including those from the World Bank and the OECD. These examine the beneficial impacts on the commercial ecosystem and sales levels at the global scale. Every additional day necessary to prepare items for external business reduces commerce by roughly 4.5 percent (OECD 2011). Policy changes in nations that function below the regional average in the APEC area might improve intra-APEC trade by $245 billion.

The last several pieces of research by the World Trade Organization (WTO) insinuate that advancements in international frontier bureaucracy all around the globe can indeed elevate multinational commerce by US$ 1 trillion per year, implying that trade facilitation can have a greater influence on global commerce than removing all of the world’s existing duties. According to the World Economic Forum study, TFA adoption might result in a 60% to 80% growth in international SME trade in certain nations.

The aims of trade facilitation were put onto the world discourse primarily due to the following four major determinants:

- The effective execution of commercial liberalization policies under WTO parameters resulted in a sizeable diminution of taxes and duties and non-tariff barriers, which is prevalent in affluent nations. This lowered the revenue activities of customs, and therefore the option of streamlining customs processes with a reasonable risk level for domestic income showed up for a substantial amount of organizations.

- Because trade transaction costs (TTC) are evaluated upon the basis of different variables and statistics ranging from 1.5 percent to 15 percent of the transaction price, the sum of import tariffs has become equivalent or even lesser as compared to trade transaction costs (TTC) in respect of customs and international frontier procedures. In the context of liberalized accessibility to global marketplaces, TTC has begun to be seen as the primary obstacle in commerce.

- The present international economic growth, premised upon Global Value Chains (GVC), has revolutionized cross-frontier products transportation. Nowadays, “transitional products,” that are constituents of the equivalent GVCs, account for up to half of overall developed-country international trade. As a result, the total expense of customs constraints for businesses has surged.

- The advancement of manufacturing operations relies upon Just-In-Time (JIT) practices and e-commerce shipping, which enhanced the demand for the speedy discharge of products by customs.